Why did your accountant miss these really large tax deductions at tax time?

When it comes to managing finances, especially in the realm of property investments and tax planning, many individuals overlook significant opportunities to optimize their tax returns. Accountants, despite their skill levels, sometimes miss out on major deductions that could save clients thousands, if not hundreds of thousands, of dollars over time. The three most commonly missed deductions usually involve investment in Self-Managed Super Funds (SMSFs). And property e.g. the use of family trusts versus holding property in one’s name. Thirdly, the timing of deductions, especially in relation to capital gains tax (CGT). This can happen for many reasons. For instance, accountants are very hesitant to even mention the word “SMSF” as they are not licensed to advise on it. Therefore, they cannot charge a fee for giving you advice on SMSF. They could tell you what they have observed people do & what the tax implications of SMSFs are – but most decide to focus their attention elsewhere. At your expense.

This article digs into each of these topics, providing insights into how individuals can better manage their finances to maximize their returns.

- SMSFs and Property Investments: The Largest Tax Loophole

Self-Managed Superannuation Funds (SMSFs) have become increasingly popular among Australians. That is because they seek to take control of their retirement savings and maximize their investment potential. That is most prevalent particularly in property. SMSFs allow individuals to pool their superannuation funds with up to four members to purchase property directly. The significant advantage of using SMSFs for property investment lies in the tax benefits. Income earned within the SMSF, including rental income and capital gains, is taxed at a concessional rate of 15%, and this rate drops to 0% once the members start drawing a pension from the fund. That is right! No CGT. The largest tax imposed on Australians does not apply to SMSFs. Got your attention?

As a result, over the next 5-10 years, investors utilizing SMSFs could potentially save hundreds of thousands of dollars in taxes. However, this substantial tax benefit is often not tapped into. With many individuals unaware of the potential savings. Accountants may miss this opportunity too. If they do not consider the client’s long-term financial goals and the suitability of an SMSF for their situation. The key to unlocking these savings starts with a thorough understanding of the SMSF structure. But one also needs to understand the extensive SMSF compliance requirements. Once you know all that then you can see how to leverage property investments with these structures. It’s a also a good idea to get a good handle on a wonderful little trust type, called the “bare” trust.

Investors should work closely with their accountants to assess whether an SMSF is the right vehicle for their property investments. By doing so, they can ensure that they are taking full advantage of one of the largest remaining tax loopholes, ultimately enhancing their wealth accumulation over time. Most accountants do not have the right license to give you advice on SMSF’s and what to do with it. Financial planners do that. However, the latter make very little money if they advise you on using these things for property. Planners will want you to invest in shares and other similar products instead, is what we’ve found so far. That is also the reason why many people never even find out about the benefits of SMSFs.

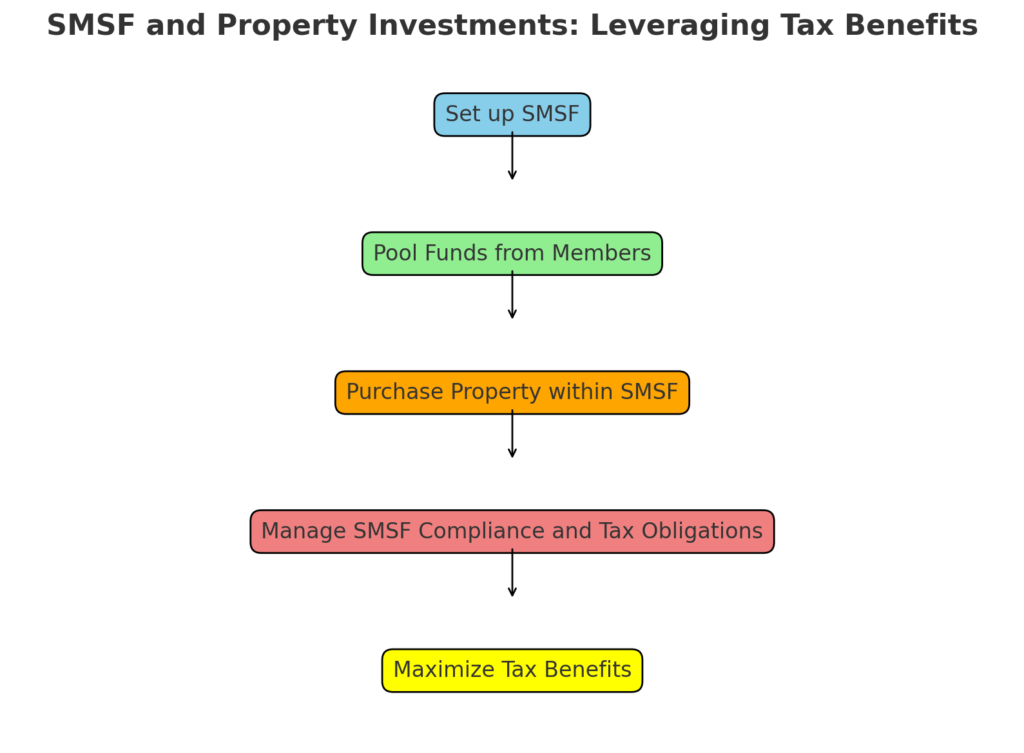

Flowchart: SMSF and Property Investments A flowchart will be provided here to illustrate the key steps in leveraging SMSFs for property investment, including setting up the SMSF, pooling funds, purchasing property, and managing tax obligations.

- Family Trusts vs. Property in Your Own Name: A Strategic Comparison

Family trusts are a popular vehicle for holding property in Australia, and for a good reason. With over 1 million trusts established in the country, it is estimated that one in every 20 Australians has a trust. This figure is even more striking when considering the context of social networks—if you have 500 friends on Facebook, about 25 of them likely have a family trust. While this might seem surprising, it’s not a coincidence. Family trusts offer several advantages, particularly when compared to holding property in one’s name.

The primary benefit of a family trust is the flexibility it offers in distributing income and capital gains. Trusts can allocate income to beneficiaries in the most tax-efficient manner, which can result in significant tax savings. For instance, income can be distributed to family members in lower tax brackets, reducing the overall tax burden. Additionally, trusts provide a level of asset protection, shielding family wealth from potential creditors or legal claims.

However, setting up and managing a family trust requires careful planning and a clear understanding of the legal and tax implications. Accountants must consider the client’s family structure, income levels, and long-term financial goals when advising on whether to hold property in a trust or in the client’s name. Missing this consideration can result in higher taxes and missed opportunities for wealth protection.

Given the potential benefits, it’s no surprise that so many Australians opt for family trusts. By understanding the strategic advantages of trusts, individuals can make informed decisions that align with their financial objectives.

Flowchart: Family Trusts vs. Property in Your Own Name A flowchart will be provided here to compare the benefits and considerations of holding property in a family trust versus in an individual’s name, highlighting key factors such as tax efficiency, asset protection, and legal implications.

- Timing Deductions: Strategizing for Maximum Tax Benefits

Timing is everything when it comes to tax deductions, particularly in the realm of property investments. Many investors make decisions based on market movements, such as selling property when prices rise by 10%. However, this approach often overlooks the impact of capital gains tax (CGT), which can significantly reduce the financial benefit of such a sale. CGT is levied on 50% of the capital gain, meaning that a 10% increase in property value could result in a substantial tax bill.

Instead of reacting to market trends, investors should focus on timing their deductions and considering both CGT and market conditions. For example, it might make more sense to defer a sale or bring it forward depending on the investor’s overall tax situation. By doing so, they can potentially save more in taxes than they would gain from the market appreciation alone.

Consider a scenario where an investor, Paul, sells a property after it appreciates by 10%, resulting in a $10,000 gain. After paying CGT on 50% of that gain, he might only see a fraction of the profit. Meanwhile, another investor, Brian, might choose not to sell during the same period, avoiding the CGT altogether. Even though Brian doesn’t make a profit, he also avoids the tax liability, potentially leaving him in a better financial position than Paul. (So, does Brian just hang on to the property forever? Well, no. There are many ways e.g. using trusts or SMSF’s to minimise/eliminate the CGT altogether with some foresight and tax planning & that is why you need to talk to an accountant)

This example illustrates the importance of timing deductions and tax strategies over merely focusing on market gains. Accountants play a crucial role in guiding their clients through these critical decisions. They can be the difference between you becoming a property millionaire or just plain missing out on a glorious financial destiny in one of the strongest economies on the planet. EnsurE that they maximize your tax benefits while minimizing liabilities – or fire them now.

This is why you need to talk to an accountant now.

Maximizing tax deductions requires a comprehensive approach that goes beyond simply tracking expenses. Or claiming an extra $150 for laundry. By strategically using SMSFs for property investments, considering the benefits of family trusts, and carefully timing deductions, some individuals can significantly multiply their financial outcomes. These strategies require careful planning and expert guidance, underscoring the importance of working closely with an accountant who understands the complexities of tax legislation. If you don’t work with one & just keep reading blog posts (yes, even this one!), you will not get there. This sort of content is generic at best and does not take into account your personal financial circumstances. So, you should definitely not start any such financial strategy before talking to an accountant, in depth. However, under our supervision (and our specialists), by taking advantage of these often-overlooked opportunities, investors can build and protect their wealth more effectively.

Sources

- Australian Taxation Office. “Self-Managed Super Funds.” ATO, 2024. www.ato.gov.au/super/self-managed-super-funds.

- Smith, John. “The Benefits of Using SMSFs for Property Investment.” Australian Financial Review, 2023.

- Brown, Karen. “Understanding Family Trusts: A Guide for Property Investors.” Property Investor Today, 2023.

- Jones, Alice. “Tax Benefits of Family Trusts.” Financial Planning Magazine, vol. 27, no. 3, 2024, pp. 45-56.

- Wilson, Sarah. “Capital Gains Tax and Property Investments: A Strategic Approach.” Taxation Journal, 2023.

- Andrews, Michael. “How to Maximize Tax Deductions on Property Sales.” Real Estate Investor Monthly, vol. 34, no. 7, 2024, pp. 12-21.

- Green, Emily. “The Role of Timing in Capital Gains Tax.” Tax Planning Quarterly, 2023.

- Roberts, Daniel. “Family Trusts vs. Individual Ownership: What’s Best for You?” Property Tax Advisor, 2024.

- Lee, Samantha. “Leveraging SMSFs for Long-Term Property Gains.” Superannuation Strategies, 2024.

- Harris, David. “Timing Your Property Sales for Maximum Tax Efficiency.” Australian Property Review, 2024.